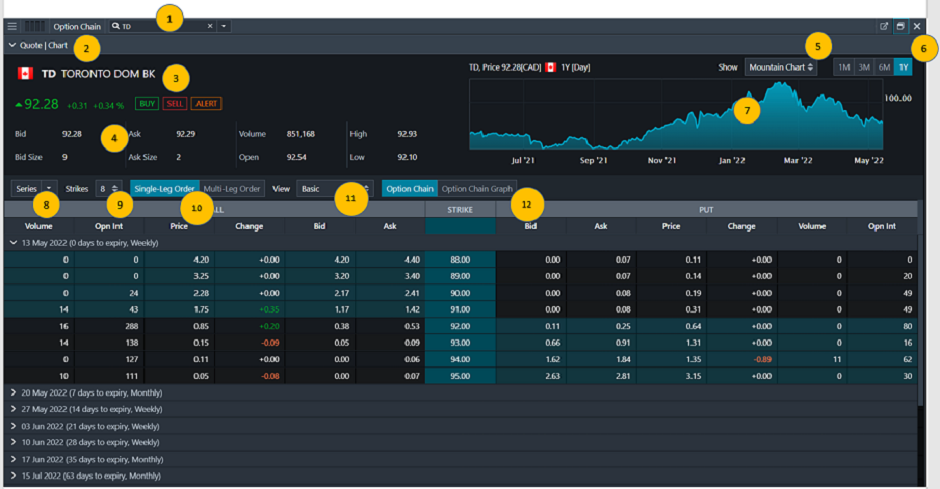

The Option Chain provides a structured display of real-time data for a selected symbol allowing you to analyze call and put options with their respective values and prices.

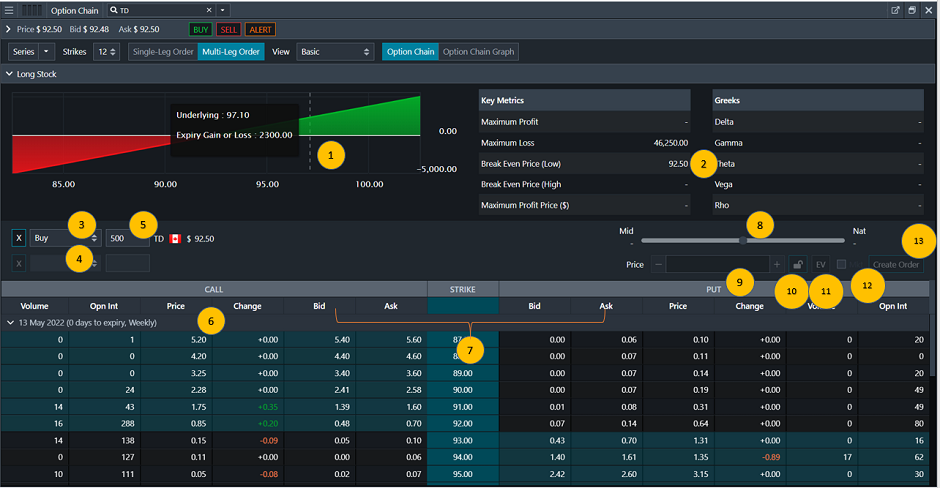

11. Select to view associated columns with Basic, Greeks, Intrinsic/Extrinsic, Probability, and Theoretical in Option Chain:

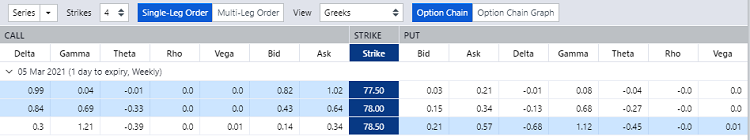

- Greek

Delta: The measure of the rate of change in an option’s theoretical value for a one-unit change in the price of the underlying security.

Gamma: The measure of the rate of change in an option’s delta for a one-unit change in the price of the underlying security.

Vega: The measure of the rate of change in an option’s theoretical value for a one-unit change in the volatility assumption.

Theta: The measure of the rate of change in an option’s theoretical value for a one-unit change in time to the option’s expiration date.

Rho: The measure of the expected change in an option’s theoretical value for a 1 percent change in interest rates

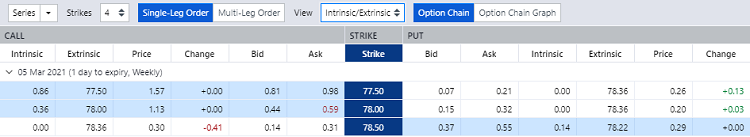

- Intrinsic/Extrinsic

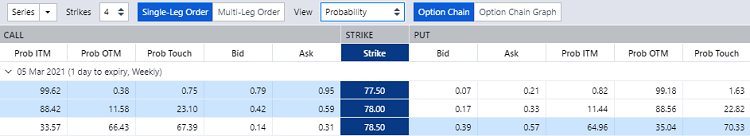

- Probability

Prob Touch: The probability of the option going 1 cent or more in-the-money before expiration.

Prob ITM: The probability of the option expiring 1 cent or more in-the-money.

Prob OTM: The probability of the option expiring out-of-the-money.

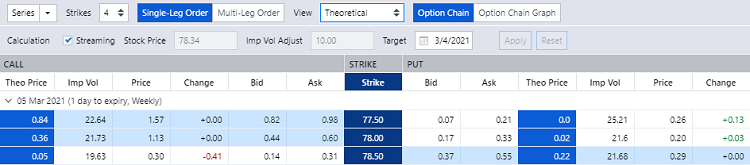

- Theoretical

Theo Price: The theoretical price of the option based on the values entered for Stock Price, Imp Vol Adjust, and Target Date.

Imp Vol: The estimated volatility of the underlying security’s price based on the price of the option.

Enable Streaming to have your theorical price to be automatically updated in real-time based on new incoming data. You can also set parameters for Stock Price, Imp Vol Adjust and Target date to calculate the theoretical price.

Multi-Leg Order

Option Chain Graph

The Option Chain Graph can display up to four graphs of various fields from the option chain to help visualize patterns and relationships among various option types, expiration cycles, and strike prices. The view is the same for both Single-Leg and Multi-Leg Orders.

Disclaimer

Probability metrics are modelled by Thomson Reuters and leverage market info such as security price, dividend yield, interest rates, day to expiry and implied volatilise derived from option prices to arrive at their calculation.

Probability analysis results are theoretical in nature, not guaranteed, and do not reflect any degree of certainty of an event occurring for any security.

These metrics and results are not reviewed or endorsed by TD Waterhouse Canada Inc., The Toronto-Dominion Bank or its subsidiaries. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Please read Characteristics and Risks of Standardized Options at http://www.optionsclearing.com/components/docs/riskstoc.pdf before investing in options.